Emirates, the long haul carrier known for its luxury services, has set new standards for the way we travel. In it’s 2019-2020 financial year, 56 million passengers and almost 2.5 million metric tons of cargo flew on Emirates to over 80 countries. But like airlines everywhere, the carrier has been battered by the coronavirus pandemic.

Covid-19 was especially devastating to airlines like Emirates.

”When we had to ground the airline for two months, that’s unprecedented in certainly my long career in this business, never seen anything like it. And it was a psychological blow actually just as well as what’s a physical blow”

Tim Clark, President, Emirates Airline

In November 2020, Emirates group announced half year net losses of $3.8 billion dollars. To keep passengers safe and on board, Emirates requires face covering for its passengers and crew, conducts on site rapid Covid tests for fliers, and allows travelers in economy class to purchase the adjacent seat on their flight.

So the question here is, will Emirates, with its network of over 140 destinations and its fleet of wide bodied aircraft, be able to bounce back from the economic fallout pummeling the airline industry?

Emirates got its start in Dubai in the mid 1980s with a dwindling supply of oil, and the Iran-Iraq war impacting its shipping container business.

In 1985, Dubai authorities launched Emirates Airline. The carrier’s maiden journey took place on a leased Pakistan International Airlines Boeing 737 flying from Dubai to Karachi.

Four years later, Emirates was travelling to over a dozen destinations. But it was cheap credit of the early 2000s, rising oil prices, and an ambitious new ruler Sheikh Mohammed bin Rashid Al Maktoum, that helped transform the airline and the city.

The goal was to transform Dubai into what it would have been seeking to be for decades – a link between East and West, a place where people would not only stop over, but also a place that people would stay as they began to heavily invest into their tourism sector and create the monuments that we now know, like the Burj Khalifa, the Palm Jumeirah. All of those were linked to the Emirates Airlines strategy of getting as many people onto those planes as possible in as short of a time as possible.

By the early 2000s, Emirates boasted travel to more than four dozen international destinations including London, Paris and Melbourne, Australia. And it was flying to hotspots most European and American carriers deemed too dangerous like Mogadishu, Kabul, Baghdad and Beirut. They were willing to service places that other airlines considered too risky. And that’s part of what Emirates Airlines tries to do. It tries to go into places that others don’t.

What Emirates realized was that, as the capabilities of aircraft were developing, not only were they able to carry more people and cargo, but the range was extended and Emirates realized that they could turn Dubai into a super hub. While the airline industry was seeing growth, from low cost carriers like Ryanair and EasyJet, Emirates was beefing up its cabin.

In 1992, Emirates became the first airline to install a video entertainment system on all its seatbacks. In 2008, it introduced the onboard lounge for its Airbus A380 passengers. In 2017, it debuted the world’s first fully enclosed first class private suite.

”Since our inception, we have been focusing on impeccable services and amenities throughout the entire passenger journey. Since our start in 1985 as well we have continued to set the pace for innovation, luxury within the travel industry.”

Essa Sulaiman Ahmad, Divisional VP for the US and Canada Emirates Airline

One can describe Emirates as what they like to call an accessible luxury. They want the image of luxury. They want their airlines to look spick and span. They want everybody to be taken care of as though they are first class while offering fares that are affordable for some of those developing world customers that they are trying to seek.

Like its regional rival, Abu Dhabi’s Etihad Airways and Qatar Airways, Emirates benefits from having a well-funded government owner and a desirable geographic location. Dubai Airport is located just eight house from two thirds of the world’s population.

Emirates is linked to Dubai’s core identity. It’s part of one of its most successful brands. The royal family has put its full political and economic capital into maintaining the Emirates image as an affordable luxury airliner. So we will see them around for a long time.

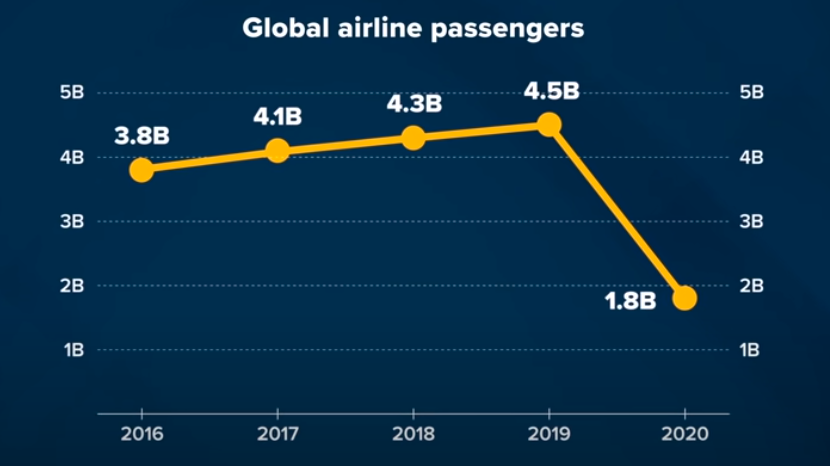

Covid-19 has had a devastating impact on airlines around the world, according to the International Air Transport Association (IATA), global passenger traffic plummeted 60% in 2020 to 1.8 billion travelers compared to 2019’s 4.5 billion figure.

Source: IATA

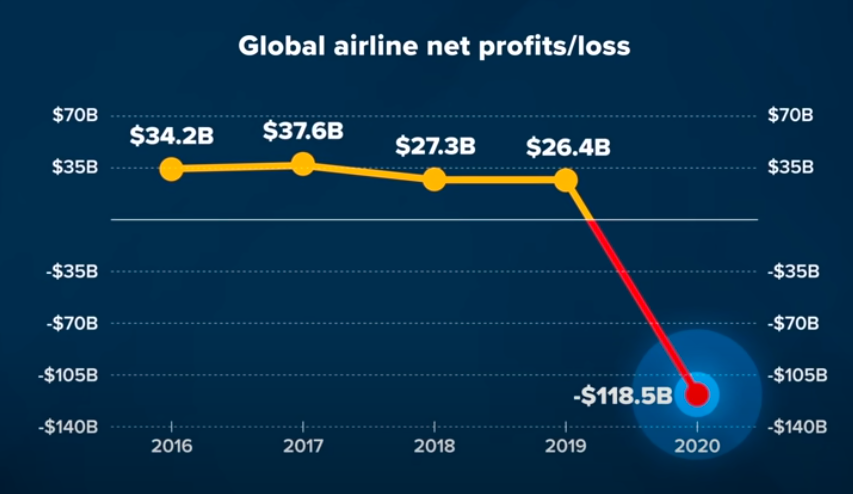

Worldwide, airlines in 2020 lost $118 billion dollars. It brought airlines to a complete standstill. Overall global demand fell as much as 95%. It has since rebounded, but it’s still far below where it had been. Depending on the country, it’s somewhere between 30% and about 45% of pre Covid levels.

Source: IATA

In March 2020, Emirates temporarily suspended nearly all of its passenger flights to and from the UAE, except for repatriation flights to about a dozen countries. That drop in passenger traffic led to the company’s first loss in its 30 year history.

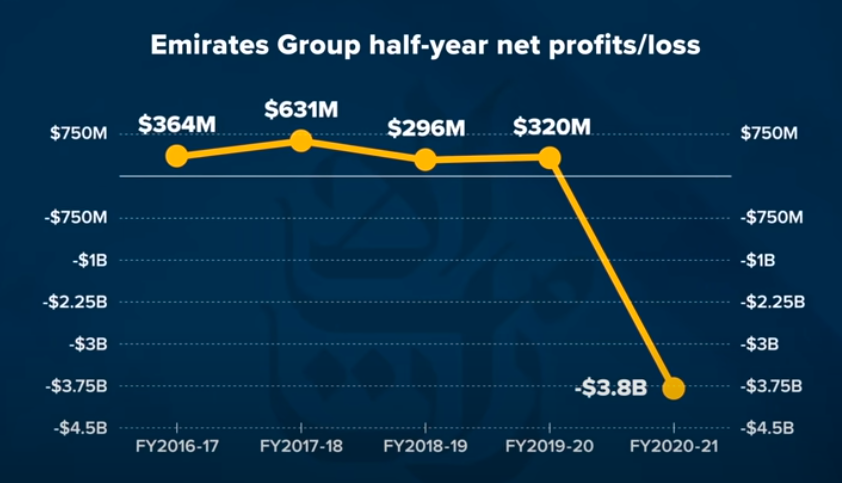

In November 2020, Emirates group announced half year net losses of $3.8 billion dollars from making $320 million in profits previously.

Source: The Emirates Group

According to analysts, Emirates, with its ultra long haul flights, may have a harder time moving back to profitability than many of its competitors.

Everything that made Emirates to be so distinctive, is basically what is working against them right now. This is the kind of travel that almost immediately stopped. People were worried about getting the disease. People were worried about spreading the disease and they worried about catching the disease.

According to analysts, long haul carriers like Emirates, face a number of difficulties, including a drop in international business travel and a laundry list of worldwide covid-19 travel restrictions. Then, that’s also the issue of your crew and your passengers are coming from many different countries. So trying to understand when you are basically checking somebody, if that person with the particular passport is allowed to enter in a given country, it will become a nightmare.

Another issue for the airline, unlike many of its U.S. and European counterparts, Emirates doesn’t have a local domestic market to fall back on. There’s virtually no intra Emirate flights. There’s no Abu Dhabi to Ras Al Khaimah flights that Emirates can move into – the way the domestic carriers say in the United States or throughout Europe were able to still move it within their own national borders, even as the lockdowns were kicking in. An additional problem for Emirates, according to analysts, is the makeup of its fleet.

While many carriers have already transitioned to smaller, more fuel efficient planes, Emirates remains the world’s largest operator of the Airbus A380. The Emirates Airbus A380 can seat over 600 passengers and has a range of roughly 9000 mile.

Airbus announced an end to its A380 program in 2019 due to lack of orders.

”Of course, the aircraft aren’t completely full and therefore we are able to socially distance people on flights, keep the crew well protected with all the PPE that they are wearing and still doing good standard service. And that has worked across the whole network.”

Tim Clark, President, Emirates Airline

Emirates did, however, find some relief in cargo while the airline had a well-established distribution network in place prior to the pandemic.

In April 2020, facing a surge in demand for PPE, it stuffed cargo on seats in economy class and in overhead bins. It also removed economy class seats from passenger planes, essentially converting them into cargo planes.

”At the beginning of the pandemic, we were focusing more on the cargo side and cargo has proved to be our sort of surviving line, if I must say, because it has helped us to mitigate whatever risks and losses that we had earlier.”

Essa Sulaiman Ahmad, Divisional VP for the US and Canada Emirates Airline

A Return to Mass Tourism

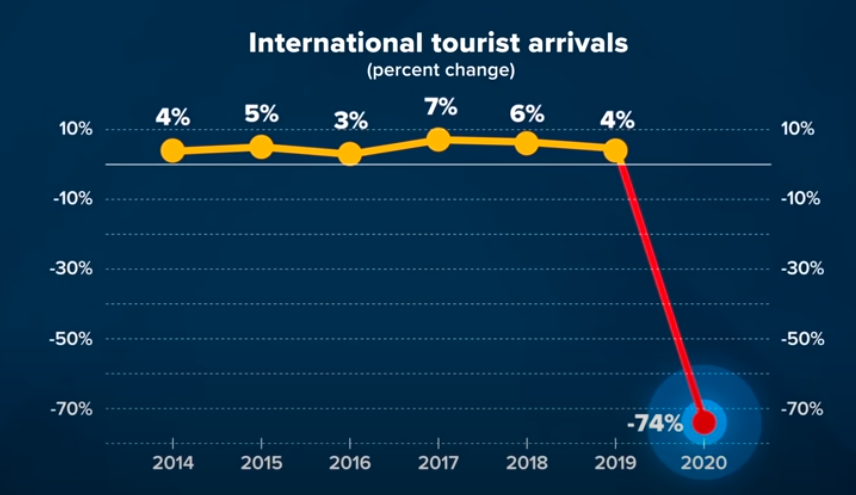

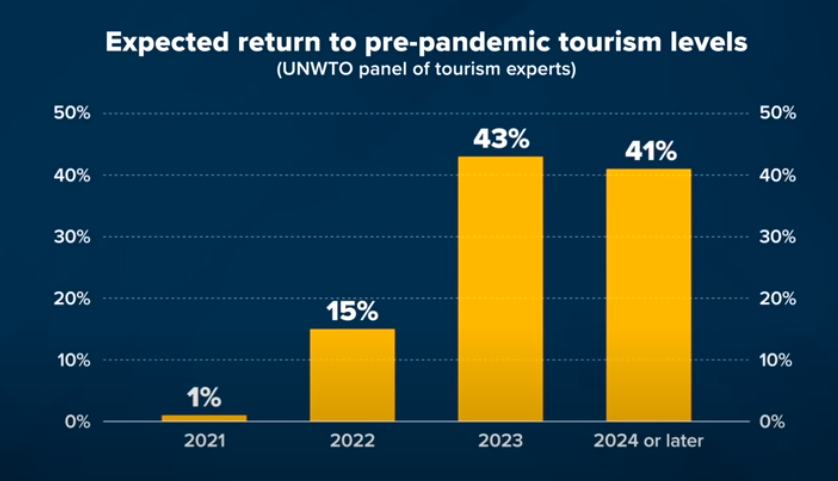

According to the UN’s World Tourism Organization, global tourism suffered its worst year on record in 2020, with international arrivals dropping by 74%. Most experts don’t expect to see a return to pre pandemic levels happening before 2023 or perhaps later.

Source: UNWTO

Source: UNWTO

”It’s a major disruption, probably the worst we have ever had. But goodness me, we have the wherewithal to try and get ourselves through it and get going again as soon as possible. And I believe that demand will return to pre Covid levels sooner than everybody else is thinking that they will.”

Tim Clark, President, Emirates Airline

In May 2020, Emirates announced 2019-2020 revenue of $25 billion dollars, 6% less than the year earlier. Passenger revenue made up 83.1% of revenue. Cargo made up 12.3%, non transport services made a 4.1%, and excess baggage made up the remainder at 0.5%.

While it waits for those tourist numbers to ramp up, Emirates is also hoping to capitalize on the global demand for vaccines.

In October 2020, Emirates announced it was setting up the world’s largest dedicated airside hub for Covid-19 vaccines at its cargo terminal.

The airline also said it was working with major pharmaceutical companies, including Pfizer, to transport vaccines around the world. It is a very high yielding thing that has been attractive to airlines and they have been building up facilities over the past few years so that they can have a bigger slice of that business.

”Certainly at the moment we are working on trying to move Pfizer vaccine in specially designed containers on our planes, in our holds, and in the cabins, and keeping them at that level through the distribution point. So we have the Chillers, we have the Freezers, we have the logistical control for the airline to get these vaccines into multiple parts of the world where others can’t do that”

Tim Clark, President, Emirates Airline

By February 2021, Emirates had delivered millions of vaccines doses to Egypt, South Africa, and Latin America, from manufacturing hubs in India and elsewhere. And once the pandemic subsides, Emirates is hoping Dubai continues to emerge as a major tourist destination.

In March 2021, Dubai launched its vision for 2040, which includes a 400% increase in public beach areas and a commitment that 60% Dubai’s areas will be nature reserves.

The growth of Emirates and the growth of Dubai are interlinked with one another. Dubai wouldn’t be where it is without Emirates, and Emirates has really turned Dubai into a global business and leisure hub. Emirates is part of the brand and it is very much part of the core national strategy. So, in that sense, nothing short of the end of Dubai, we will see the end of Emirates. Emirates is linked to the royal family in a very big way. That is an advantage because they are too big to fail.

And more than anything, Emirates is hoping for a speedy return for international travel demand in saying it will serve all of its 143 destinations by the summer of 2021.