KakaoPay Insurance, South Korea’s leading digital non-life insurance provider, has reached a major milestone, exceeding 1.5 million enrolments for overseas travel insurance within just one year of its launch. This rapid growth, unprecedented in the Korean insurance industry, has catapulted KakaoPay Insurance to the top of the market, with an average monthly growth rate of 30.7%.

This success is particularly remarkable in a market where digital channels account for only 4.5% of the industry, which remains heavily dependent on physical channels such as insurance agents.

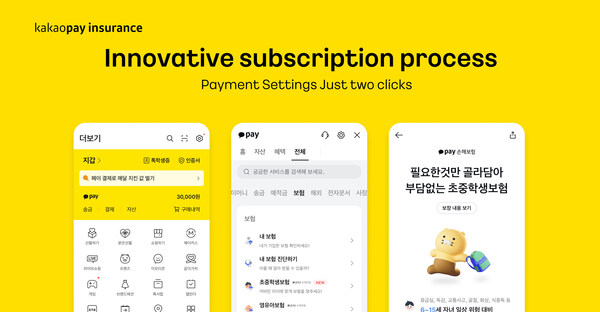

Since its founding in 2022, KakaoPay Insurance has launched a range of innovative, user-centric products, including financial safety insurance, mobile phone insurance, driver insurance, and infant insurance. By leveraging KakaoTalk, South Korea’s leading messaging app used by more than 80% of the population (41 million users), the company has fully digitised the insurance experience. Every step, from enrolment to claims, has been streamlined for simplicity and convenience, with cost savings passed on to customers.

KakaoPay Insurance’s offerings have quickly gained popularity through word-of-mouth, leading to a series of successes. For example, mobile phone insurance saw one million enrolments within six months, while driver insurance attracted over 10,000 enrolments in just one week. The company’s fast and significant growth is credited to its advanced technology and a strong focus on user needs.

“We will continue to reward our customers with even better services and benefits, staying true to our original mission,” said Youngkun Chang, CEO of KakaoPay Insurance. “The innovations we’ve implemented across the entire insurance process, from enrollment to claims, will continue to drive our progress.”