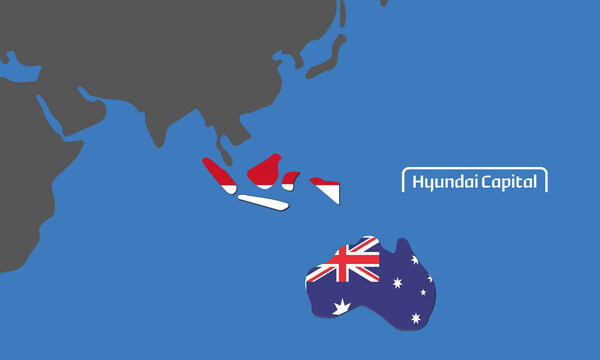

Hyundai Capital Services announced that it acquired the Australian Credit License last month to set up Hyundai Capital Australia and finalised the acquisition of PT Paramitra Multifinance in Indonesia.

Hyundai Capital Australia, a captive finance company of Hyundai Motor Group, is set to commence pilot operations in July of this year and launch full-scale operations nationwide in November.

Hyundai Capital Australia aims to strengthen financing options for Australian customers looking to purchase Hyundai Motor Group vehicles.

The new entity will offer highly competitively priced financing options, including a ‘Guaranteed Future Value’ product which offers lower monthly payments by deferring part of the vehicle price until the end of the agreement.

Furthermore, Hyundai Capital Australia is committed to improving customer experience through seamless digital services.

The entity will introduce cutting-edge digital platforms and tools to streamline document screening, reducing the processing time significantly.

Simultaneously, Hyundai Capital Services completed the acquisition of PT Paramitra Multifinance, a specialised credit financial company in Indonesia, to establish an Indonesian entity.

Operations in Indonesia are scheduled to commence fully in April of the following year.

The Indonesian financial sector presents significant opportunities for Hyundai Capital Services due to its demographic profile, robust macroeconomics, and rapid economic growth.

Also, Hyundai Motor Group’s establishment of a regional production and sales base in Indonesia in 2022 aligns with the Group’s future mobility strategy.

Partnering with Sinar Mas Group, one of the largest conglomerates in Indonesia, the newly launched entity aims to leverage local expertise to enhance and develop auto financial services in strategic regions of the country.

The Indonesian entity will offer a variety of financing options and tailored services for Hyundai Motor Group customers.

In addition, the new Indonesian entity will introduce a dedicated mobile application for dealers to conveniently create quotations and go through the credit review process on mobile devices or tablets, along with a digital approval system to streamline processes and significantly reduce processing time.

Mok Jin-won, CEO of Hyundai Capital Services, emphasised the company’s focus on marketing and digital excellence in the competitive auto finance market.

He said, “Hyundai Capital has developed unique skills and strengthened its capabilities in marketing and digital fields through fierce competition with various financial companies in the auto finance market.”

“We are finalising the acquisition of financial licenses and business approvals in Australia and Indonesia to deliver cutting-edge financial products and solutions to customers in both regions. Hyundai Capital will bring fresh air the ‘K-Finance’ in the global consumer finance market,” he added.

With operations in 14 countries, comprising 17 entities and two branches worldwide, including the United States, Canada, the United Kingdom, Germany, and Brazil, Hyundai Capital Services has shown significant growth, reaching a total of 158 trillion won ($113 billion) in global assets last year.

The company aims to further expand its global presence in alignment with Hyundai Motor Group’s global mobility strategy.